Few industries compare to the world of financial technology (fintech) when it comes to the pace and speed of innovation. From mobile banking and peer-to-peer lending to AI-powered robo-advisors, fintech apps have revolutionized the way we manage our finances. Gone are the days when you had to spend hours waiting in line at banks. The customers of today expect nothing less than accessible and convenient financial services tailored to their spending habits and always-on schedule.

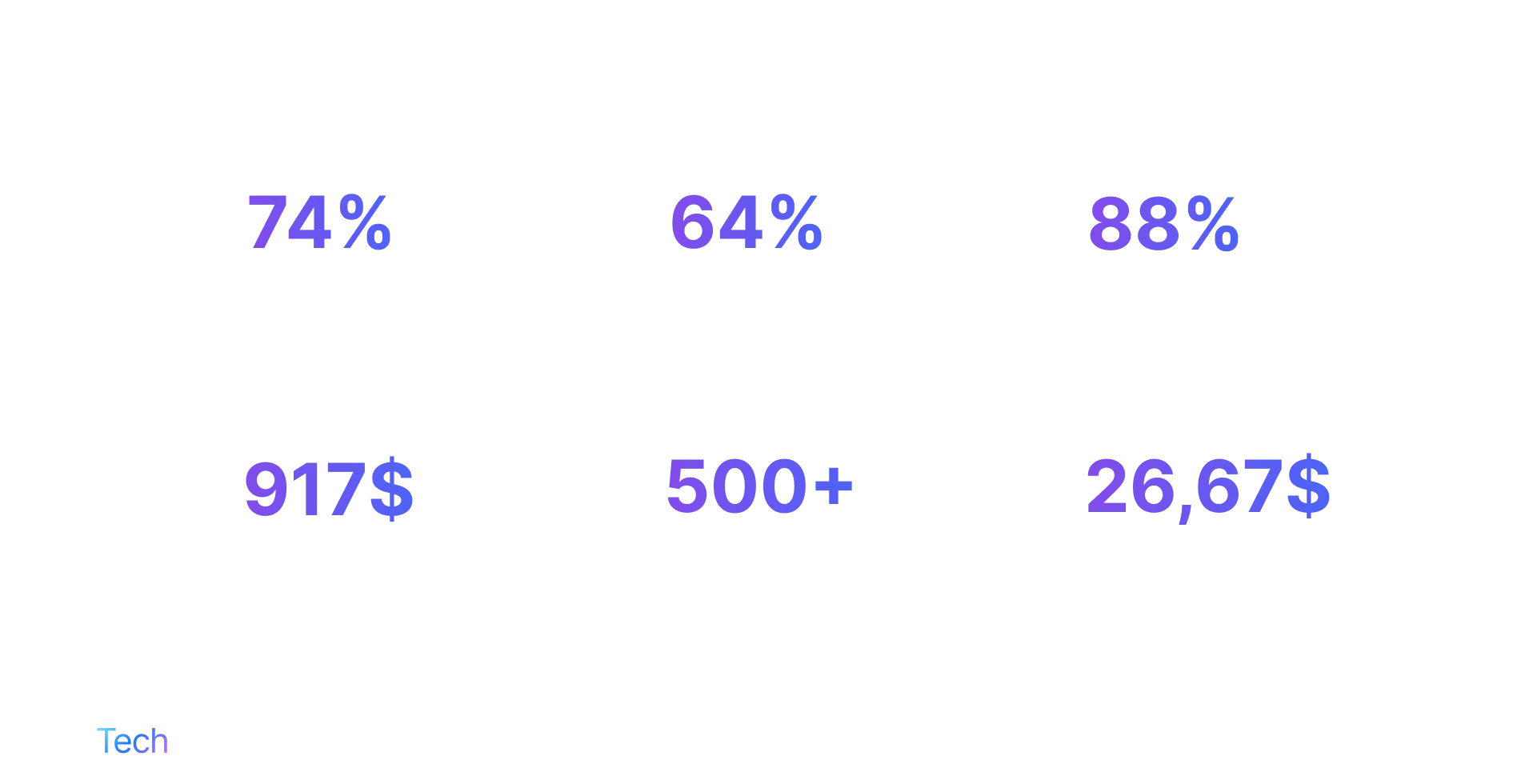

With more than 500 fintechs launched every year, the landscape is evolving rapidly. New players are entering the market and existing players are constantly expanding their offerings to provide customers with more options than ever before. As a fintech entrepreneur, you’re probably wondering how fintech app development can help you ride this wave of opportunities and stay ahead of such fierce competition.

If you’re thinking about building a fintech app, consider this the sign you’ve been waiting for. 2026 promises to be a year where investments in fintech make a strong comeback after the pandemic dip. In this guide, we’ll walk you through all the important steps of fintech application development, including how to avoid common pitfalls like choosing the right tech stack or minimizing software development time and cost.

Fintech App Development in 2026

Fintech companies may have had a rough ride during the pandemic, but in 2026 they are undergoing a noticeable revival. According to industry stats, from 2026 to 2035, the market is expected to grow annually by 15%, reaching a whopping value of more than $1251.26 billion by 2035. To put things into perspective, this is almost eight times more than what it used to be in early 2020 when the pandemic went global.

Accelerated digital transformation efforts, strategic partnerships between fintechs and traditional financial institutions, and artificial intelligence have all contributed to a tectonic shift in familiar business models, creating new services and opening new doors. Because of this companies are seeing an increase in funding related to fintech app development.

There is an incredible demand for fintech solutions, software, and other digital technologies that can simplify how consumers and businesses manage money and engage in financial transactions. In fact, 78% of people under 40 said they would remain with their traditional bank only if it went entirely digital. The interest from both users and investors is clearly there, which makes 2026 a great time to embark on your first fintech app development journey.

Fintech Market Trends

One of the first steps in building a successful fintech app is understanding the landscape. This means that when you create a fintech app you are working on correct assumptions and you invest in coding features that are in line with the direction the fintech market is heading in. VCs are seeking to fund fintechs that are capable of exploiting new technologies and emerging niches. Let’s take a closer look at a few of these trends:

- Financial inclusion and niche fintechs: Financial technology is gradually empowering underserved populations, minorities, and different age groups to access more inclusive services. An example is SilverTech which caters exclusively to the elderly, allowing them to plan for retirement and manage healthcare expenses.

- Increased banking mobility: Banks are feeling the pressure from fintechs and are increasingly shifting to smartphone and web apps to provide their core services on the go. The pandemic has accelerated this trend as neobanks challenge the status quo of in-person banking.

- API as a product: APIs play a key role in enabling connectivity and integration within the fintech ecosystem with Open Banking being a driving factor. Once silent behind the scenes, APIs are becoming full-fledged products that companies like Plaid, Galileo, and Marqueta are monetizing.

- Embedded finance: Embedded finance is the process of integrating financial services like bill payment, insurance, and loans into non-financial platforms. For e-commerce platforms, embedded finance services are particularly useful since they create a cohesive user experience without leaving the app.

- Blockchain and smart contracts: Blockchain has removed a lot of the barriers in financial transactions including authorization from intermediaries like banks. Smart contracts enable exchanging and storing data in a tamper-proof and transparent way using blockchain.

- The growing role of alternative data and big data: Fintechs are using alternative data like social media activity or wearable devices to enrich their customer data and offer access to financial services to previously ineligible users. Collecting so much information makes managing Big Data a major concern for fintechs.

Common Types of Fintech Applications

As we’ve already seen fintech is a huge industry that covers not only a variety of business models but also different types of fintech apps like:

- Payments/payment gateway

- Mobile banking

- Investment and wealth management

- Lending and borrowing

- Personal finance

- Insurance

- Regtech software

- Trading solutions

- Digital wallets

Before you build a fintech app you should carefully consider the category it falls under, your target audience, and how they use the application. Let’s review some of the most popular types in depth.

Banking apps

Digital banking apps give users access to all the main services of a physical bank from the comfort of their own homes. They allow users to open bank accounts, manage their credit and debit cards, transfer funds, and make mobile payments without having to visit a brick-and-mortar bank. The biggest advantage is, of course, convenience — you have 24/7 access and control over your money.

Insurance apps

InsurTech apps remove a lot of the clunky processes and bureaucracy involved in applying for different types of coverage, ranging from property and pet insurance to life insurance. With these fintech apps, users can purchase insurance plans, file claims, and get instant help from customer support. InsurTech systems integrate AI-powered analytics and the Internet of Things (IoT) to better assess risk and offer personalized insurance policies based on a person’s lifestyle and risk profile.

Personal finance and budgeting apps

Millennials are known to dislike traditional financial institutions. They are also the generation that will inherit the largest amount of personal wealth according to predictions. With money management as a growing concern for this segment, it’s no wonder the popularity of personal finance and budgeting apps is skyrocketing. These apps allow users to get better insight into their spending habits and plan accordingly, get tax advice, and organize their finances.

Investment apps

Similar to personal finance, investment apps are on the rise. With more than 80% of millennials saying they are not expecting to be able to retire, more and more people are looking to secure an alternative stream of income. Investment apps offer an easy and affordable way for people without prior experience to create and manage investment portfolios, receive advice from specialists, or automate investment decisions with the help of robo-advisors.

Lending apps

Peer-to-peer lending apps open up new opportunities to secure funding for small businesses or individuals straight from other users, offering them alternative ways to apply for a loan. Instead of getting loans from banks and paying high interest rates, they can access more attractive options, including borrowing smaller amounts of money which they can return without any interest.

Cryptocurrency apps

These applications make the whole experience of using virtual currencies in everyday life smoother. In a lot of ways, cryptocurrency apps overlap with other fintech apps but instead of using money, they use crypto coins. For example, you can store coins in your crypto wallet just as you would in a regular digital wallet, or you can use an exchange app to swap regular money for crypto. When developing an app, it’s also important to consider how it handles taxes on crypto transactions to ensure you’re managing these financial aspects effectively.

Best examples of fintech apps

Wondering what other players on the market are doing? We’ve handpicked some of the most successful fintech apps in 2026 according to several of the main rating platforms.

Revolut: one of the most popular fintech apps in the digital banking sector. Revolut grew incredibly fast, reaching 25 million customers worldwide just last year. It offers various services that help users manage, trade, and invest their money, including cryptocurrency.

Venmo: owned by PayPal, Venmo remains a favorite in the United States for peer-to-peer payments. The app makes it easy to split the cost with your friends, whether it’s a restaurant bill or rent.

Robinhood: one of the first finance apps to make the world of investment more affordable to beginners. You can start investing with just a few dollars, and buy and sell stocks or cryptocurrencies without additional fees.

YNAB: with Mint shutting down in March of this year, users are looking for alternative budgeting apps. YNAB doesn’t disappoint, bringing to the table an easy way to take control of your finances and set saving goals.

Lemonade: the app covers everything you need to insure your home, pet, or personal belongings. Like most fintech apps it works on both iOS and Android, which means you can buy insurance or track submitted claims wherever you are.

All the fintech solutions you need, in one place

From mobile banking apps to fraud detection systems, we develop a wide range of solutions compliant with AML, KYC, PCI DSS, and GDPR

Reasons for Developing a Fintech App from Scratch

If you’ve read this guide so far, then you’re probably well aware that the demand for fintech apps is at an all-time high. And it’s not just start-ups that are reaping the benefits of fintech app development. Banks themselves are looking at new ways to attract customers with innovative features and user-friendly apps. To get the upper hand over their larger competitors, a lot of fintechs are partnering with an app development company to create their product from scratch for several compelling reasons.

Customize fintech app development to your users’ needs

From Netflix movie recommendations to customized playlists on Spotify, we have grown accustomed to apps that engage us on a personal level. As customers are getting personalized experiences in other areas of their lives, financial services and products need to keep up. However, unlike these other areas, fintech is quite a complex subject. If you develop a fintech app that is too complex and requires a steep learning curve, you might lose a big part of your audience – an OECD report suggests only 34% of adults have a minimum level of financial literacy.

This is why customizing your product to meet user needs is a crucial step in building a fintech app. On the one hand, you need to make your solution easy enough to use regardless of financial know-how, and on the other hand, users require flexibility. A tailored fintech app gives you full control over it and allows you to find the right balance between inclusivity and personalization.

Cut down development costs with fintech APIs

Twenty years ago if you wanted to launch a financial application you had to build even the most basic features on your own. Not a lot of companies had these kinds of resources, which explains why only banks and huge corporations in the finance industry could afford it. Nowadays, SMEs and start-ups can rapidly build and deploy fintech apps without spending years or tens of thousands of dollars in development. And it’s all thanks to one element: third-party fintech APIs.

By using third-party APIs, you can significantly reduce the number of implementation steps. Rather than reinventing the payment system wheel, you can integrate with payment processors such as Stripe or PayPal. Similarly, by using Open Banking APIs, you get access to a wealth of customer financial data you can use to add value to your product – like better credit scoring based on actual consumer behavior. However, for greater control over transactions, fees, and security, building a payment gateway using fintech APIs offers flexibility to customize payment flows, detect fraud, and support multiple payment methods

Meet compliance requirements from day one

Today even smaller companies can develop fintech apps fast not only due to third-party APIs but also third-party expertise. A big advantage of working with a specialized fintech app development team is that you can address any legal compliance requirements as early as the development process. Dealing with finances requires adhering to a huge list of standards and laws. You have to comply with Anti-Money Laundering (AML) regulations when handling financial transactions. There are also data privacy laws like GDPR or CCPA you have to consider when collecting user data.

Integrating compliance procedures and top AML software into your development process from the early stages improves your app’s security, protects user data, and secures your business from potential risks. For example, when testing features where real data is not necessary, we use masking techniques to replace sensitive user information with mock data. We also conduct regular data protection assessments and work closely with our clients to document any data governance rules the development team needs to follow.

Easier support and maintenance as you grow

No one builds a mobile banking app to have it sit and languish in the Google Play or App Store. Instead, you want your fintech app to grow and reach as many people as possible. But scalability goes beyond an infrastructure that can support thousands of server requests. You also need to make sure your fintech app remains bug-free as you scale and that you can handle customer questions or concerns as quickly as possible.

Another reason to develop a fintech app from scratch is that once you build the application according to strict specifications it’s easier and cheaper to maintain it over time. Clean code makes it easier for developers to intervene when something goes wrong and clear features means your customer support team will not have to battle angry emails or support tickets.

Core Features of Fintech Apps

Speaking of clear features, functionality is one of the most important aspects that will define your app. While there isn`t a one-size-fits-all solution, most fintech applications need to include at least some of these features to be a viable product and stay compliant.

Secure authentication

When an app holds all your financial information, the last thing you want is to worry about your data ending up in the wrong hands. Any fintech app must comply with security requirements to protect users from the moment they create an account. Strong authentication, including complex passwords, is needed to verify each user’s identity, and transactions must be verified through SMS codes or two-factor authentication. As technology and security practices evolve, biometric authentication like facial and voice recognition or even retinal scanning are also gaining traction.

Integration with payment methods and banks

The majority of fintech apps need to ensure users can send and receive money or make online transactions. The easiest way to do so is to integrate with a third-party payment processor or directly via bank APIs. Different customers prefer different payment methods, so consider offering multiple options like QR code payment or e-wallets to eliminate the hassle for your audience. A lot of people prefer e-wallets over cards because they don’t have to enter their credit/debit card details each time they make a payment.

Real-time notifications

Financial data flows are heavily regulated and every fintech app must comply with these standards. This includes keeping users informed at all times of any changes or activity taking place in their accounts. With the help of real-time notifications and alerts, users can keep track of everything that is happening, and receive updates from tech support or news and offers that are relevant to them.

Customer support chatbots

No matter how intuitive your fintech app is, sometimes your customers will have questions that need to be handled fast. Ideally, your fintech application should provide a chatbot that can answer routine questions and take the load off your live customer support reps. Truly effective customer services have multiple contact points with chatbots as a main self-service feature, while unique inquiries can be further escalated to a human.

Financial dashboards

Fintech apps offer a convenient way for users to track their finances, whether it’s setting financial goals or monitoring their credit scores. Dashboards and visualizations are a great way to see everything at a glance and have all the information you need readily available. Dashboards can aggregate financial data from multiple sources so that users can see their transaction history or other valuable records all in one place.

Automation and Machine Learning

Nowadays almost any fintech app offers some degree of automation. It can be something as basic as setting a schedule for automated payments or as complex as streamlining your entire invoicing process through RPA and specialized invoice software. While tools like Google Docs can help users easily create an invoice for smaller needs, fintech apps take this to the next level with integrated automation and scalability.

Just as automation has become commonplace, by now AI has also become a necessity rather than a nice-to-have functionality. Machine Learning algorithms can help companies assess risk, make forecasts and informed business decisions, and offer better services.

Tech Stack Required for Fintech App Development

Your tech stack isn’t just a set of tools, it’s the backbone of your operations and your app development process. First of all, you will need to determine if your fintech app will run on web, mobile, or cross-platform. Let’s look at some of the most advanced technologies used for these types of apps.

Web fintech apps with React and Node.js

React and Node.js are by far one of the best combos for fintech web applications. Just think of how much real-time data fintech apps have to process. But with Node.js on the backend, this isn’t an issue due to its capacity to balance high server loads. On the frontend, React can update pages without reloading them, which again makes it a great fit for real-time financial data.

Native iOS and Android fintech apps with Kotlin and Swift

Given that fintech apps gravitate towards mobile technologies, chances are you will be faced with the question of native vs. cross-platform development. If you decide to go native, Kotlin and Swift are some of the most popular iOS and Android frameworks for native fintech mobile app development. Although native apps come with certain perks like being able to work offline, they are on the pricey side. You will need to maintain separate codebases for each platform.

Cross-platform fintech apps with React Native

Luckily, there is another alternative: cross-platform apps. This way, you will only need to write and maintain a single codebase for both iOS and Android, saving development time and costs. There are multiple languages you can use for cross-platform app development like Xamarin, React Native, and Cordova. However, it’s important to know that Xamarin and Cordova are also a bit on the pricier side, which is why a lot of developers prefer to use React Native (saving up to 50% in the process!)

Of course, in addition to your main programming languages or frameworks, you might also consider using reliable software development tools that help your team collaborate efficiently and keep the development process organized. Key elements of your tech stack could include:

A powerful database: PostgreSQL, MySQL, MongoDB, Cassandra, Redis

A cloud services solution: AWS, Google Cloud Platform, Microsoft Azure

DevOps tools: GitHub, Jenkins, Puppet, Docker, Kubernetes, New Relic

API security: OAuth 2.0, OpenID Connect, OWASP API Security, Postman

5 Steps to Developing a Fintech App

Now it’s time to break down the question “How to develop a fintech app” into actual steps. The process requires not only significant technical expertise but also a good understanding of the market and target audience. By partnering with a fintech app development company you can streamline a lot of these technical steps and focus on your business strengths instead.

Step 1: Research target audience and market gaps

The first step to building a fintech app that attracts users and generates income is to learn as much as possible about your market. Who is your target audience? Who are your competitors? Are there any gaps in the market your new app can fill? If users can find a better alternative in your product, they will likely move towards you and so will investors. Start with a blueprint, like some of the core fintech features we’ve outlined above, and then add at least one feature that will make you stand out. In your research, consider incorporating localization of software to appeal to users in various markets. A localized app can provide a seamless user experience across languages and regions, making your product more accessible to a global audience.

Step 2: Create a project brief and plan features

Once you have your market research down, you can figure out which type of fintech app is suitable to tackle the problem and you can start planning budget and features. There are a lot of different types of fintech applications you can develop. For example, a bill payment solution can help users quickly pay all their utilities for different service providers in cash just by scanning a barcode.

You will have to define the scope of your MVP (Minimum Viable Product) in a project brief. The software development brief is a concise document that aims to outline the goals, requirements, and solutions so that you and your development team are on the same page. When creating the brief consider these steps:

- Have a product discovery workshop with your development team to clarify which features are a must-have and what tasks users can perform using the platform.

- Discuss technical requirements and if there are any existing constraints – maybe you need to integrate with legacy systems or older databases.

- Set milestones for each major feature before going into detailed planning.

Step 3: Design an intuitive user interface

Good UI/UX is essential for any application but even more so for fintech apps. In the fintech industry, applications are designed to guide users through various financial activities. The more complex the workflow is, the cleaner and more intuitive the interface has to be. Let’s look at an area financial applications still struggle with: onboarding.

Fintechs have to gather enough information about their users to comply with regulations like Know Your Customer (KYC) and more. However, asking for too many details at first signup can put users off. The solution? You can use progressive signup to collect information as you go or use gamification and profile-o-meters to give users a sense of satisfaction when filling in their info. Smart UI/UX makes it obvious at each stage how the data you are collecting is actually benefitting the users.

Step 4: Build and test your MVP for security and compliance

With design, user stories, and an outline for the first release in hand, it’s time to start MVP development. Keeping in mind security and compliance risks, fintech app development includes a lot of moving parts. Here are just a few:

- For obvious reasons, always encrypt data and use API penetration testing to find any vulnerabilities in your APIs

- The user should be required to re-enter their password if they want to perform any high-risk action.

- Even when developing or testing on staging environments, only the last three digits of the credit/debit cards should be visible.

- If you integrate third-party APIs, do a thorough vendor assessment check first.

- Follow a Zero Trust security model inside and outside your organization. This means users, devices, and applications should always be verified before giving them access to sensitive data.

Step 5: Launch and iterate based on feedback

An MVP will help you get in front of your audience fast so you can collect feedback and improve your product. Conduct A/B testing and keep track of user comments in a spreadsheet or a specialized usability testing tool to understand what is confusing or misleading for them. To further understand user behavior, implementing Real user monitoring (RUM) can provide invaluable data on how your audience interacts with your app. Don’t be afraid to ask questions and make adjustments once you discover something isn’t working. The best part about Agile development is that you can repeat this process until you reach a perfect solution without disrupting your existing workflows.

What Does It Cost to Build a Fintech App?

Our Helpware Tech team has built and launched countless fintech apps, from small but mighty MVPs to Open Banking solutions that access data from banks across the whole of Europe. The average cost of fintech app development can range anywhere from as low as $30,000 to as high as $350,000. This is why to get a better view of estimates and budget you should consider the following elements:

- App complexity: how many features do you plan to include in the app and how complex are they? If the application doesn’t require blockchain development services or additional technologies like Machine Learning then the second biggest impact on the budget will probably be tying in all the API integrations into a coherent app logic.

- App platform: As we’ve seen, costs for developing a web, mobile, or cross-platform app can vary not only between platforms but also inside the same category depending on the language or framework.

- Post-development costs: Apart from this, you should also consider app maintenance and support costs.

If you’re just beginning your fintech development journey, we recommend starting with a basic version of the application that includes just the right amount of components to test your idea on the market. We offer free consultation calls to learn more about what you’re working on and exchange know-how.

Outsource Fintech App Development to Helpware

We hope this guide covered everything you need to step into the world of fintech application development with confidence. Application development for FinTech is in demand and will only continue to grow as fintechs challenge banks to revisit their old ways. Our team at Helpware is here to help you turn promising ideas into result-driven applications. If you have any questions, feel free to reach out to our experts for a consultation call.